London founders are calling time on office space postcode vanity. The West End office badge now drains runways and can slow hiring too. Is the West End no longer hip? Possibly. But there are other options.

Farringdon delivers the same quality, amenities for 25-40 somethings who all look for a better work-life balance, and that feeling of being in a business hub too, with better access – all for far less. The numbers and comparisons make the choice too hard to ignore.

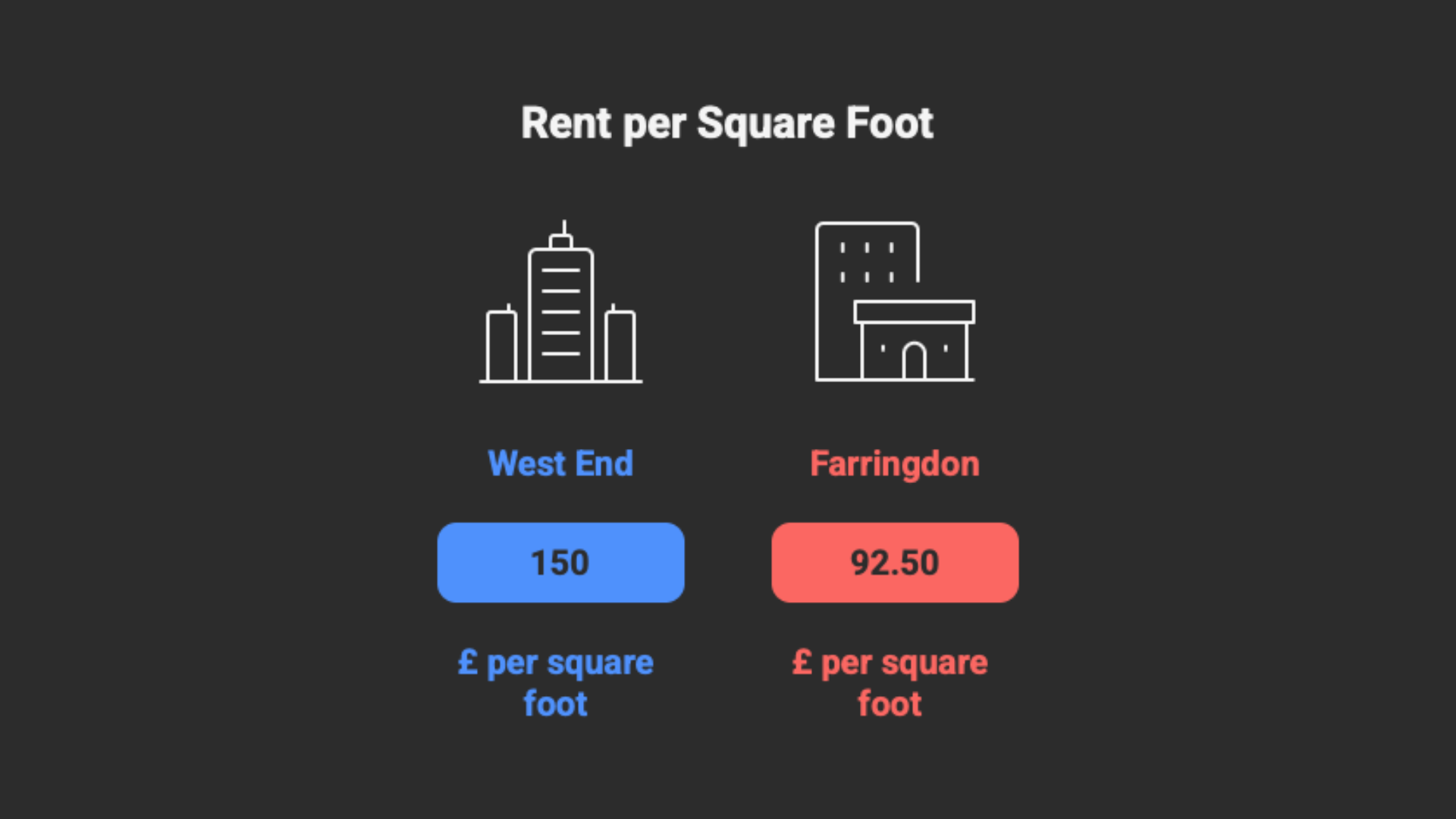

Knight Frank reports West End Core Grade A office rents are at £150 per square foot versus £92.50 in Farringdon. On 10,000 square feet, the ‘Mayfair tax’ is an eye-watering £575,000 a year.

This is amplified by a West End Core Grade A vacancy rate of just 0.3% in 2025, which signals a scarcity premium that many founders will not subsidise.

Companies are already voting with their feet. Cushman and Wakefield recently recorded the highest west to east migration since 2015, with tech leading the shift.

The logic is simple: pay less for modern office space with better reach and avoid bidding wars for a logo on the door.

Is connectivity now the primary filter for office space decisions?

The market says yes. Ashby Capital reports that Elizabeth Line locations jumped from 43% to 51% of all London lettings in a single year. That’s a massive leap.

Their data also shows these districts recorded 12% above trend take-up while non-Elizabeth Line districts were 11% below trend.

CBRE confirms occupiers now ask for Elizabeth Line office locations in briefs rather than a specific postcode, and Knight Frank adds that the best rental performance is clustering around connectivity hubs.

Farringdon sits at the intersection of Thameslink, Underground and the Elizabeth Line. That reach beats many W1 addresses for client access, airport routes, and staff commutes.

The line has driven 46.6% nominal rent growth in Farringdon over ten years by unlocking genuine occupier value, including faster direct links to Heathrow and Canary Wharf.

Real moves are validating the shift. GSK is moving its global headquarters to the Tottenham Court Road Elizabeth Line catchment after two decades in Brentford.

Anton Page reports that Snapchat, TikTok and Depop both chose offices around Farringdon Station to plug into the network and talent flows.

The winners are buildings that trade on great local amenities, speed, reliability and multi-modal access. Not just a prestige W label.

Are migration patterns rewriting the office rental rulebook?

They are. The London AI Hub choosing Farringdon over W1 signals where future talent wants to gather. Knight Frank counts 6,960 high-growth tech firms in the capital, a cohort that prioritises time savings and optionality.

The same report flags a 3.3 million sq ft West End shortfall by 2028, which turns scarcity into friction.

Cost simply amplifies the shift. Add typical West End 10-year office space commitments, even with long rent-free periods, and the prestige premium functions as a tax on inflexibility.

What do connectivity hubs deliver that W1 cannot?

For decades, W1 has set the benchmark for office prestige and proximity to influence. Yet as occupier priorities evolve from brand address to operational efficiency, the definition of “prime” is shifting too. Connectivity hubs now compete not through status but through measurable performance. The emerging pattern shows that advantage increasingly belongs to locations that compress time, costs, and friction.

That shift is already visible in the advantages these hubs deliver:

- Shorter decision cycles with more choice in live schemes and pipeline

- Office lease optionality that supports scale-ups and contractions

- Faster airport and financial district access for sales and investors

- Proximity to emerging clusters shown by the AI Hub decision

- Better value per productive hour, not just per sq ft

- Smart money alignment, with investors backing infrastructure-led submarkets

The pattern is not anti-West End, it is pro-efficiency, and that same logic is already reshaping south of the river, posing the question of who moves early enough to capture South London office rental upside before the market prices it in.

Why connectivity-first choices are outpacing W1 premiums (and how ADAPT helps you move first)

Founders are done paying a scarcity and prestige tax for W1. With high costs, near-zero vacancy, and decade-long commitments, the friction now outweighs the badge. Connectivity-led hubs like Farringdon are winning on access, optionality, and value too. ADAPT’s role is simple: help high-growth teams unlock those advantages without compromise.

We translate the market’s shift into action. Using ADAPT’s AI-led intake, we capture how your team actually works, then surface a curated Top 10 across Elizabeth Line and multi-modal nodes-Farringdon, Paddington, Tottenham Court Road-and emerging South London submarkets.

Each option is benchmarked on total cost (not just £/sq ft), travel-time savings, airport and client reach, and lease flexibility. Our off-market access and 360° service mean you avoid bidding wars for scarce W1 stock.

We help you secure fitted/managed solutions that scale up or down, with the right meeting rooms, breakout space, and brand potential too. Transparent fees replace broker games, and our deep provider relationships compress timelines so you can act before the market prices in the upside.

With 20+ years’ expertise and deep operator ties, ADAPT’s team have helped thousands of founders redirect significant six-figure annual savings into talent and runway, while landing offices that boost productivity and hiring.

Connectivity is the new currency of London office space success. Our job is to convert that into flexible, right-sized deals that give founders time back and eliminate the postcode premium and enjoy the best possible workspace.” Chris Meredith, ADAPT CEO & Founder

What can you do to get ahead of London’s connectivity-first office space shift?

London’s office space map is being redrawn around connection, not convention. For businesses tied to legacy leases or planning for scale, the smartest move now lies along the Elizabeth Line and other high-access corridors. Flexible space is no longer a trend, but a strategy.

ADAPT helps businesses make that workspace shift with precision, from identifying the right location in Farringdon, Tottenham Court Road, or South London, to helping design space that evolves as they do, all with hybrid office working in mind. That’s what we call the ADAPT difference: turning change into a competitive advantage.