Rents for sustainable office space in London are higher, and fit outs also carry a premium. Scale-ups that want prime space often pause when they see the numbers. Yet that premium is not a sunk cost. It reflects a new way of creating value in the workplace and a market that has already tipped in favour of ESG buildings.

Why are green London offices more expensive?

Green buildings in London typically command rent premiums of 11.6% according to JLL, while capital values are about 20% higher. These premiums arise because tenants expect lower operating costs, healthier indoor environments and stronger reputational benefits. What looks like higher rent on paper usually transforms into lower total cost of occupancy.

The shift is structural. Research from Heriot-Watt University found that while only 2.7% of offices were green buildings by count, they make up 12% of total office space in the UK.

In London, more than half of premium office completions now carry green credentials. Institutional investors now own 70% of this stock, showing that sustainability is no longer a niche but the default in the capital’s office market.

What does the sustainability premium really buy?

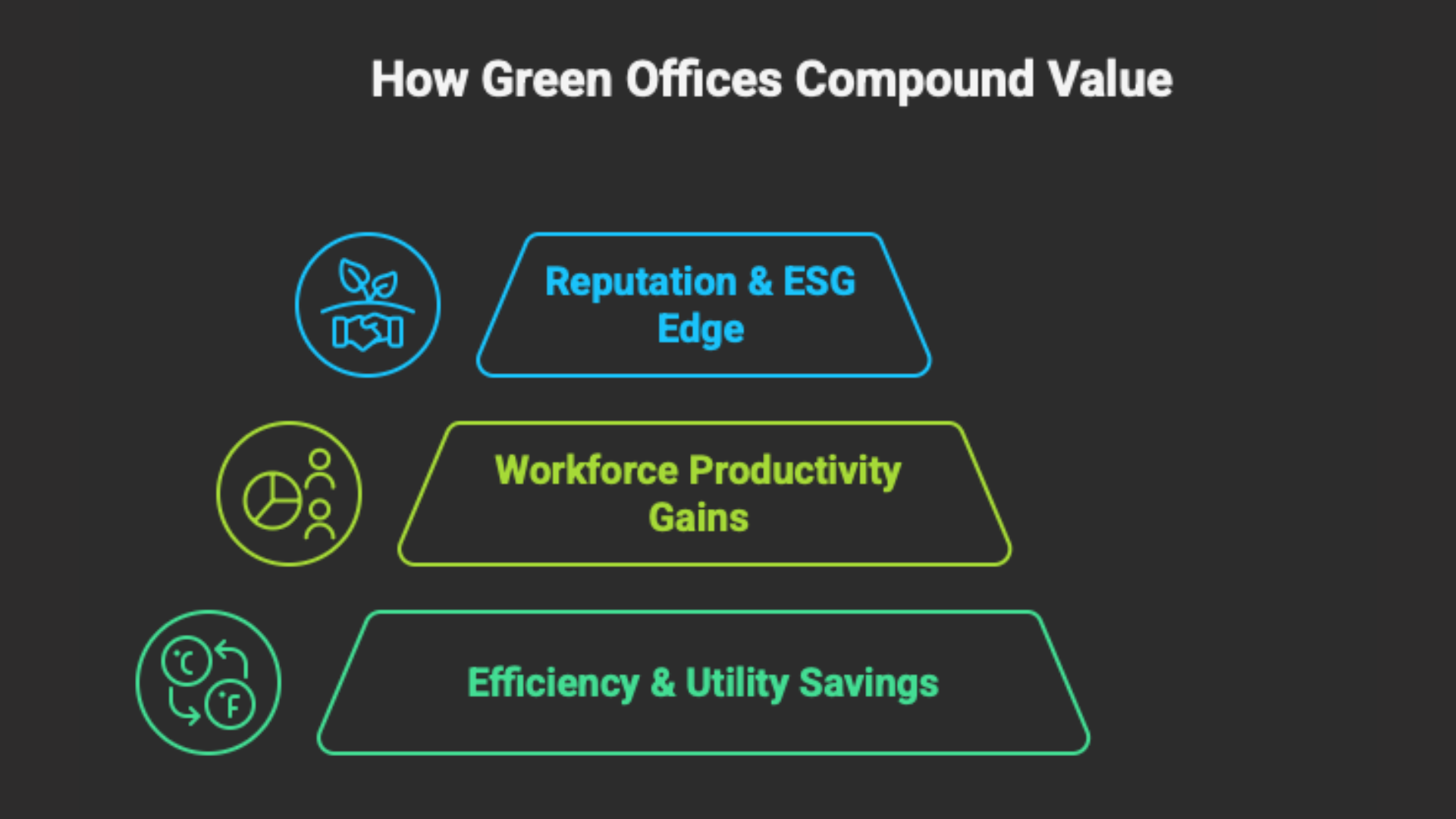

Growing businesses often see the direct cost first and the indirect benefits second. The premium supports a workplace that delivers energy efficiency, higher staff performance, and stronger brand positioning. In practice, returns often outweigh initial costs.

Key factors driving the higher upfront cost include:

- More advanced design and construction standards

- Investment in high performance systems that reduce energy and water use

- Strong demand from tenants with net zero targets

- Institutional investor control of the majority of ESG-certified stock, which sustains pricing power

The real question is not whether to pay more for green office space, but how quickly those premiums convert into operating advantages.

How does the sustainability premium turn into payback?

The return on green office space investment begins with lower running costs. Certified buildings use less energy and water, which cuts monthly bills from the first day of occupation. For scale-ups, that means preserved cash flow for growth rather than utility payments. Even modest efficiency gains across a 12-month lease cycle create visible savings.

The next channel is workforce productivity. Better air quality, daylight access and stable indoor temperatures improve focus and reduce fatigue. Healthier staff translate into fewer sick days and stronger output. For CFOs, these outcomes shape the real return on occupancy, as payroll impacts from lost productivity can easily outweigh marginal rent differences.

Reputational value further compounds the benefits. Tenant demand for green space is driven not only by regulation but by corporate positioning. A London firm showing credible ESG practice meets investor expectations and gains an edge in recruitment. Certification becomes evidence of real commitment, strengthening client relationships in sectors where sustainability credentials influence procurement.

Together these factors explain why an 11.6% rent premium often recoups itself within a single lease. Savings on bills, more productive people and stronger market standing operate cumulatively. For scale-ups managing rapid headcount growth, these compounding effects are not optional extras but critical operating levers.

How do tenants make green features work for them?

Not every sustainability badge represents the same value for occupiers. BREEAM-certified buildings in central London often show the strongest rental and capital performance, but what matters most is how well a building’s features align with a tenant’s actual operating priorities. A firm needing deep floorplates for collaboration may value design flexibility over certification status.

Execution lies in prioritising features that reduce total occupancy costs. Forward-thinking tenants negotiate green lease clauses where energy savings are shared and monitored. Verifying projected versus real savings ensures benefits are tangible.

When lighting and HVAC improvements deliver measurable returns, payback within a single lease cycle becomes clear, positioning sustainability as an operational advantage rather than a compliance cost.

Key practices include:

- Prioritising location and design quality above labels

- Negotiating clauses that share efficiency savings with the landlord

- Auditing and verifying building performance rather than relying solely on projections

- Leveraging visible sustainability to support talent recruitment and retention

- Pre-letting quality green space early before supply contracts

Pre-letting activity across London already clusters around highly sustainable buildings, with the best spaces often taken before completion. Companies that delay face tighter supply and diminished choice. For scale-ups balancing flexibility with growth, moving early into ESG-strong offices secures both cost control and culture advantage.

Turning sustainability premiums into growth advantages with ADAPT

London’s most desirable green offices come with a higher upfront cost, but one that pays back fast through lower bills, healthier teams, and stronger brand equity. The challenge for scale-ups is knowing which buildings, features, and lease structures will actually deliver those returns – and that is where ADAPT comes in.

With two decades of experience and deep market access, ADAPT helps growth businesses decode the difference between projected savings and real, measurable outcomes.

With two decades of experience and deep market access, ADAPT helps growth businesses decode the difference between projected savings and real, measurable outcomes.

We guide clients toward ESG-certified spaces where energy and productivity benefits are verified, negotiate clauses so savings flow back to the tenant, and secure pre-let opportunities before the best stock disappears. More than an office search partner, we ensure workspace investments align directly with company culture, team needs, and long-term strategy.

Our results speak for themselves: scale-ups we’ve placed in sustainable spaces consistently report higher retention, reduced operational drag, and offices that strengthen rather than strain cash flow. That credibility comes from treating sustainability not as a compliance tick-box but as a growth lever.

The real decision isn’t whether you can afford the green premium – it’s whether you can afford to miss the compounded returns it creates. Our job is to translate that into the right building, the right deal, and the right terms for every client.”

Chris Meredith, ADAPT CEO & Founder

What can you do to get ahead of sustainable office ROI?

If your business is growing, competing for talent, or under pressure to show credible ESG action – now is the moment to act. Green office space in London is limited, and the best options are often pre-let before completion. Acting early ensures you capture both the operational savings and the reputational lift that sustainable buildings deliver.

With ADAPT, you gain more than just the right workspace for today. You build the foundation for long-term cultural strength and financial resilience. That’s what sets ADAPT apart: Spaces that are flexible, tailored, and built for the future. Explore your options now.