Choosing the right London office location is no longer about paying for the right postcode. In the hybrid office era, the biggest driver of value today is transport connectivity. Businesses that understand this shift are finding ways to cut costs by millions without losing access to either clients or talent.

How has transport reshaped London’s office space hierarchy?

For decades, prestige London West End and City postcodes like E1, W1, WC1, and E14 dictated office space rents. That logic is being overturned by transport-led value. Properties within 500m of a tube station command around a 10% premium compared to those further away, and proximity to stations has become one of the primary forces shaping rent levels.

The Elizabeth Line has been the biggest disruptor. Properties around its 41 stations have seen price growth up to 25% above the London average.

Commute times from areas once considered random or just too far out, like Shenfield and Maidenhead, have dropped dramatically, making them competitive with West End and City addresses.

At a global level, analysis shows occupiers place transport hubs above postcode prestige when selecting office space. In London specifically, every five minutes of walking distance closer to a hub like Liverpool Street can add around 4 to 7% to prime rents. That’s huge, so you can imagine how much that truth has been eroded since the Elizabeth Line changed the landscape.

The result is a new geography of value where transport links, not traditional prestige postcodes, dictate where smart firms position their offices.

What is the office rent mechanism behind the transport premium?

The relationship between transport access and office rental prices is measurable and consistent. Every five minutes closer to a major hub increases rents significantly – and these increments compound quickly across the market.

For example, a building ten minutes closer to a key Elizabeth Line interchange can command nearly 15% more in rent than one slightly further away.

This premium reflects employee convenience as much as client access. Businesses are paying for speed and certainty of connection rather than postcode status.

Variation is also visible when analysing office desk costs along London’s tube lines. Average monthly costs on the Jubilee line reach £718 per desk, compared with £598 on the Hammersmith and City line – that’s a 20% gap.

This is driven more by line reputation than actual differences in connectivity. These spreads mean firms with similar space requirements can face rent bills millions of pounds apart depending on location choice.

This makes transport-led analysis essential to decision making.

Where are the hidden value zones in London?

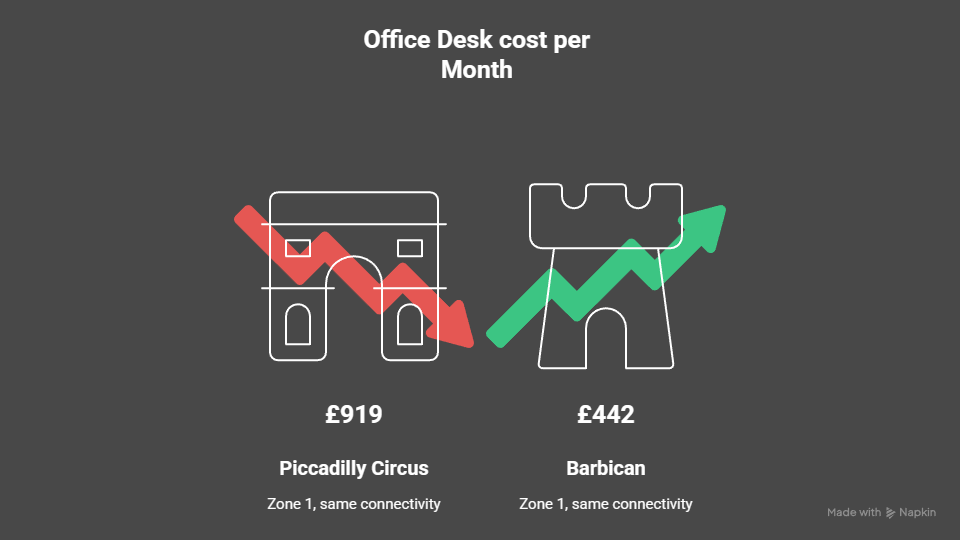

The financial upside of looking beyond headline postcodes is clear. At Barbican, the average desk costs sit at £442 a month compared with £919 at Piccadilly Circus.

Both deliver Zone 1 connectivity, yet one location is less than half the price. For growing firms, this means identical access to talent and clients without paying a West End premium.

Transport data helps uncover these opportunities. Savings exist where new routes like the Elizabeth Line boost a station’s reach but pricing has not yet caught up.

Or where multiple intersecting lines provide resilient commuting options. Businesses that map connectivity rather than relying on postcode reputation gain an edge in both cost management and recruitment.

Key signals of hidden office space value include:

- Stations adjacent to new infrastructure but not yet fully repriced

- Interchange points where two or more Underground lines meet

- Areas with strong east west or north south links that reduce reliance on a single hub

- Locations offering walkable access to multiple corporate submarkets

What this demonstrates is that prestige does not equal performance. Employees care more about a reliable, short commute than about working in a postcode linked to heritage and hedge fund-style old school wooden-panelled office swankiness, the likes made briefly popular by the TV series Mad Men and by Warren Buffett at the height of his pomp.

And clients rarely notice whether a meeting is held two stops away, but the savings across an entire lease cycle are significant.

The space itself is key and the most rational option often lies just outside the boundary of traditional hotspots.

How ADAPT helps businesses unlock London’s hidden value zones

The data is clear: smart firms can save millions annually by shifting focus from prestigious postcodes to transport-driven value. But identifying those precise sweet spots is not straightforward at all – especially when the market moves quickly and pricing has not yet caught up with connectivity changes.

This is exactly where we at ADAPT come in. Backed by 20+ years of founder expertise, ADAPT helps businesses cut through postcode assumptions and uncover hidden opportunities powered by transport links, not legacy prestige.

By mapping growth patterns around hubs like the Elizabeth Line, combining desk cost analysis with connectivity insights, and identifying off-market options, ADAPT ensures clients gain both cost savings and team satisfaction.

The outcome? Companies secure offices that employees love – spaces that are flexible but also cool, fresh, affordable, and tailored to culture – without overpaying for a pointless postcode label. With ADAPT as a partner, organisations avoid costly mistakes and can re-invest savings into growth instead of rent.

London’s office market has been rewriting its own rules since COVID and the Elizabeth Line changed the landscape,” says Chris Meredith, ADAPT CEO & Co-founder.

“Our job is to help companies see beyond outdated location hierarchies and make smarter, data-led choices that give them financial, talent attraction, and cultural upside. Soho and Mayfair aren’t over, but they’re not the hubs they once were.

“And yes that can lead companies to look across various areas around Old Street and Shoreditch, but that’s now the tip of the iceberg.

What can you do to get ahead of London’s new transport-led office market?

If you are negotiating a lease renewal, planning to expand any time soon, or simply questioning whether your current space reflects how your team works in the new hybrid era, now is the time to act. The prestige postcode premium is fading fast, and transport-driven value zones are creating rare opportunities to save millions without sacrificing accessibility. ADAPT can unlock you amazing office space options you may not have thought about.

ADAPT can help you reframe your office strategy around connectivity, not legacy status – finding not just an address, but a launchpad for growth. That is the ADAPT difference: spaces that cost less, work harder, and inspire more. You can start smarter office hunting here.