Many businesses do not know that the very best office space in London rarely reaches public listings and actually gets snapped up before it makes it on to office broking websites or commercial property portals.

Severe supply shortages of fantastic flexi office spaces mean prime and exclusive properties are often taken before they hit the market. For companies looking to secure a strategic location, the real game is played off-market, often with flexible or managed spaces – where relationships, timing and information can set you up for an amazing deal. This is the world ADAPT operates across.

What is really happening in London’s office market?

London’s office sector effectively runs on two tracks. Public listings only show part of the story, while the most competitive spaces are traded privately or snapped up behind closed doors. According to Knight Frank’s Q4 2024 report, private capital accounted for nearly half of all deals, with sovereign funds and institutions securing many prime assets behind closed doors.

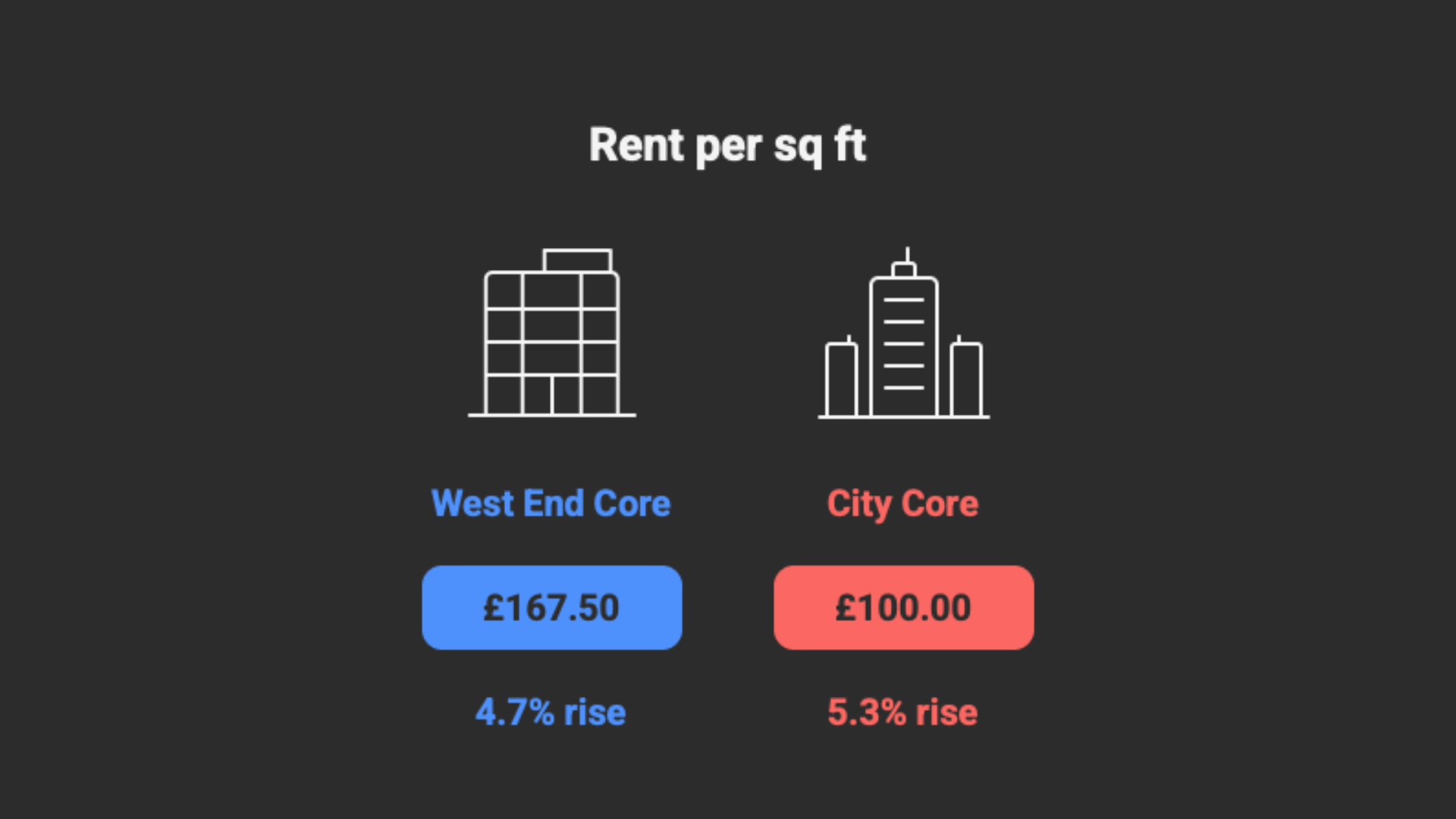

At the same time, rents are climbing quickly in core areas. City Core rents rose 5.3% to £100 per sq ft, while the West End core reached £167.50 per sq ft after a 4.7% rise. These increases highlight how scarcity fuels competition and funnels activity into private channels.

Vacancy levels reveal just how tight conditions are. MSCI reported new build vacancy of only 0.6% in the City and 0.3% in the West End, so new spaces are not popping up to replace the good stuff that’s already occupied either.

For large occupiers, the imbalance is especially stark: CBRE identified 33 active requirements for space above 100,000 sq ft, yet only 22 such spaces were available! That gap forces companies into closed-door negotiations long before listings appear or into the hands of market experts who can unlock off-market deals on amazing office workspaces that you will not see online.

In practice this means:

- The largest requirements often bypass public listings entirely

- Landlords prefer direct talks with experts they trust, to test serious interest quickly

- Businesses with market intelligence move faster than competitors stuck churning out the same offices as each other

- In the managed and flexi era, publicly advertised spaces represent only a fraction of true activity

Adding to the opacity is the “grey space” effect, where tenant-controlled sublease stock shifts quietly. Cushman & Wakefield found that 29% of availability in late 2024 came from such space, with nearly three quarters withdrawn privately as firms reoccupied rather than sublet.

These moves rarely appear on traditional searches.

London’s office market is therefore less about browsing listings and more about accessing people, behind closed-door networks, and early intelligence. Like many industries, it’s all about who you know!

Why do off-market deals depend on relationships?

The off-market environment is driven by information asymmetry. Knowing who might be rethinking their footprint before anyone else is a competitive edge. Cushman & Wakefield noted that 78% of movers in 2024 upsized their offices, meaning many were competing for larger floors before they were officially marketed. Direct access to decision makers allowed them to move ahead of the wider market.

The mechanism is straightforward. Limited supply combined with urgent corporate demand gives an advantage to firms that can negotiate privately. Landlords prefer quiet conversations with credible operators, brokers, and commercial property experts with a track record to reduce friction, while occupiers prefer dealing with trusted parties rather than signalling too much free space to the open market. In this setting, access and trust determine who secures the best space.

How do you map an invisible network before you need it?

Execution in London’s off-market office world means preparing well before space becomes available. CBRE’s research shows only around one third of large requirements translate into public take-up, with the rest resolved privately or redirected elsewhere. Relying solely on listings leaves businesses at a systematic disadvantage.

The smarter approach is to anticipate where opportunities will surface. That requires direct engagement with occupiers and landlords, as well as close monitoring of market signals. This is everything ADAPT does, 24/7, so you do not have to.

Practical steps include:

- Building relationships with corporate real estate teams who hold decision-making power

- Tracking upcoming lease events using public filings and local intelligence

- Watching for early signs such as consolidation announcements or merger activity

- Maintaining dialogue with landlords who quietly test demand before committing to marketing

With vacancy so scarce, invisibility is often the default. Preparation, monitoring and strong office industry relationships replace browsing as the real currency of access.

Turning hidden office space opportunities into strategic advantage

London’s most valuable office space rental opportunities are rarely visible on the open market. Limited supply and growing demand mean that the real leverage lies in relationships, intelligence and preparation – not in browsing property websites online. Rightmove alone will not cut it for you.

This is where ADAPT steps in: by bridging the gap between what businesses can see publicly and what is actually available behind the scenes.

With more than 20 years of experience and deep market relationships, ADAPT helps clients map the invisible network before they need to sign. Instead of chasing what is left, we proactively identify off-market spaces, track lease events, and connect directly with decision-makers. The result is access that competitors simply do not get, delivered with flexibility to suit each client’s growth stage.

For scaling businesses, that translates into more than just square footage. It means avoiding costly compromises, protecting culture, and positioning for growth in one of the world’s most competitive office markets. Our track record of securing exclusive spaces – often before they are publicly known – is what sets us apart.

The London office market does not reward those who wait for great office listings and amazing deals to appear online. They simply won’t! It rewards those who prepare, connect early, and negotiate quietly. That is exactly the space where ADAPT operates.

Chris Meredith, ADAPT CEO & Founder

What can you do to get ahead of off-market London office deals?

If you are planning a move this year, scaling your headcount, or stuck in a lease that no longer works for your team, the smartest time to act is now, and to look for exclusive office space availability, before the great spaces go properly public. Off-market intelligence is not just about speed – it is about positioning your business where the best spaces open up first. ADAPT works in this area…

We can help you secure flexible, tailored office space that aligns with your culture, protects your future growth, and gives you access to deals competitors will never see. That is the ADAPT difference – combining exclusive market insight with spaces that truly feel like a home for your business. Explore office options with ADAPT today.