London’s office market looks flush with empty office blocks and wide availability, yet prime office rents are at record highs, which may look odd for any wannabe bargain hunters in buzz areas of London.

Vacancy rates suggest leverage for tenants to grab a great deal, but businesses needing modern workspace discover quite the opposite. The illusion comes from published industry averages which do not take into account flexi and managed spaces properly, or off-market gems.

Aggregate statistics hide the divide between outdated, unwanted stock (like high rises that have been sat empty for years) and the scarce, high performing offices perfect for hybrid working that smart firms will actually want to compete for in the post-COVID, AI era. Great growth space is out there, but it needs discovering!

Why do vacancy rates mislead companies looking for a new office to rent?

Central London vacancy rates have climbed to historic highs, with Knight Frank reporting availability close to 9% in early 2025. On the surface, this suggests oversupply and a dealhunters paradise. Yet new build vacancies are effectively zero – 0.6% in the city and 0.3% in the West End. In reality, quality space you would want to rent in Central London is more exhausted than you may think, as obsolete floors sit empty.

K2Space data reinforces this split, showing overall vacancy touched a 20 year high of 10.6% in 2024, while Grade A vacancy in the City and West End dropped below 0.5%.

Businesses needing efficient, compliant, well located offices are competing for a fraction of the market. This explains why West End rents now reach £160 per sq ft, with premium deals commanding up to £200 per sq ft, and why City rents are pushing past £100 per sq ft with quarterly growth still accelerating. It’s an odd picture.

What makes this a dangerous illusion?

When vacancy is discussed as a single helpful number, decision makers assume falling office rental costs are theirs. Yet record rents tell the opposite story.

The averages conceal an uncomfortable truth: there is plenty of space, but little that meets operational, regulatory, and even ESG demands, and the great stuff for scale-ups is often off-market too – especially managed spaces and slick flexi options. The oversupply story is not easing budgets but actually distorting smart decisions.

The numbers show the trap clearly if you look at the City:

- London vacancy is near at 10% overall (in 2025)

- Prime West End rents averaging £160 per sq ft, premiums are up to £200

- City core rents rising past £100 per sq ft

- Grade A buildings drove over 70% of leasing in 2024 while poor quality stock stayed idle

The lesson is clear. Supply is not equal to choice, and averages will mislead anyone planning without segmentation of different types of spaces by area, office type, type of agreement and many other things. This widening gulf in building performance sets the stage for the next reality: the flight to quality that defines London’s market.

Why does the flight to quality split the market?

London’s vacancy data is misleading because it hides a structural divide in what is actually available. While the stock of ageing buildings grows, almost no top grade space remains sat there gathering dust in core/ in-demand districts. Tenants that require efficient, ESG-ready offices are left with virtually no choice, which is why demand concentrates so heavily on modern buildings.

BNP Paribas data shows Grade A offices accounted for more than 70% of leasing in 2024 even though they make up only around a quarter of existing stock. Regulation further locks this pattern in place.

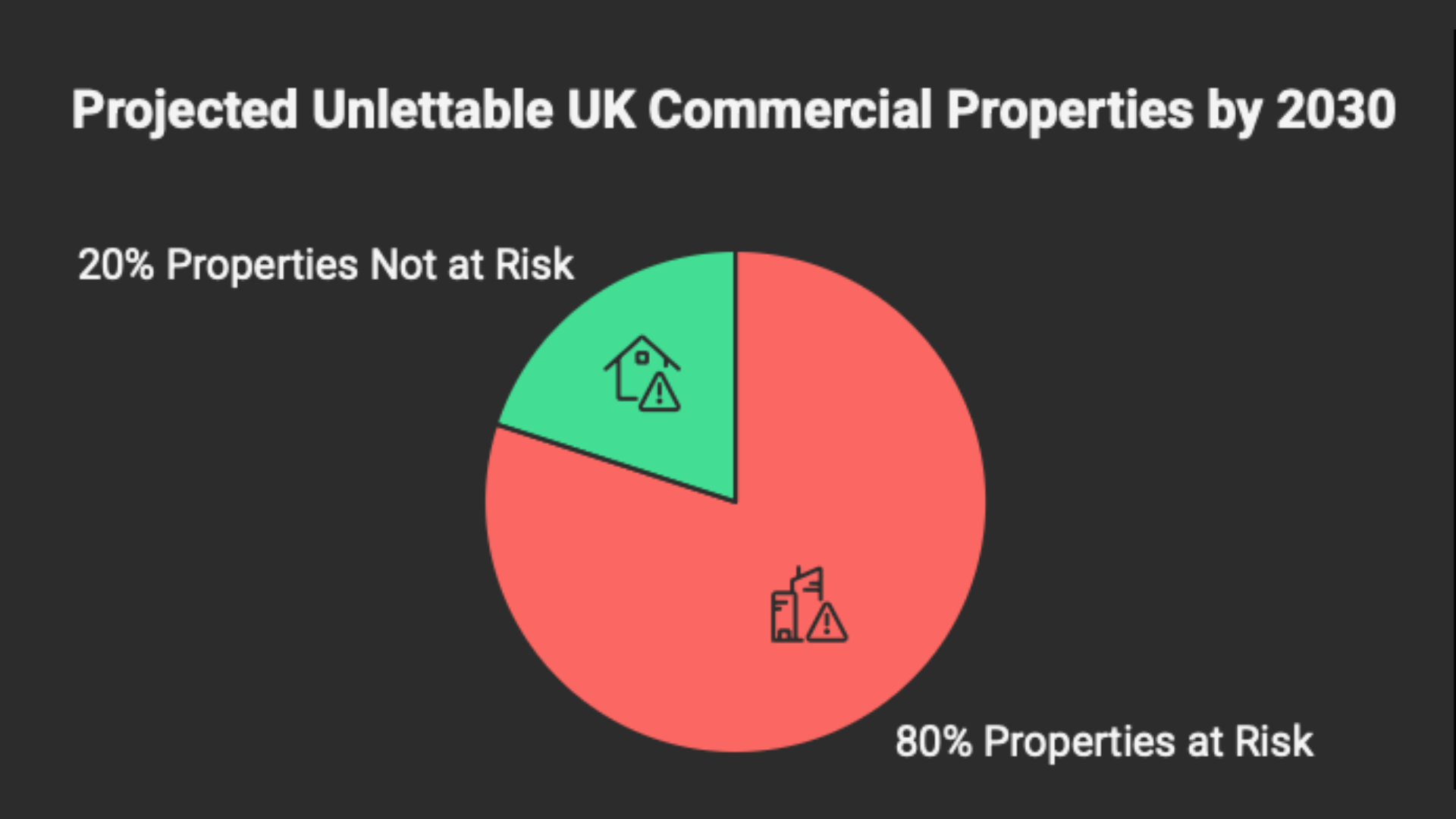

More than 80% of UK commercial properties risk being unlettable by 2030 without major upgrades, this is a huge problem and means a large share of today’s vacant offices cannot legally serve tenants within the next five years.

Landlords holding outdated buildings fit for another area face write downs, while new, compliant assets and buildings fit for growth in top areas command steep premiums.

This ‘bifurcation’ explains why more construction has not alleviated record rents. Despite millions of sq. ft. under development, overall net absorption remains negative while premium assets continue to absorb strongly. The illusion of choice comes from counting obsolete floorspace in supply totals.

What matters to office tenants who know what their looking for is the sliver of viable, efficient space where competition is fierce, everything else is irrelevant.

The result is a paradox where abundance sits alongside scarcity and where averages conceal the true pricing drivers at the end people actually want.

How is market data distorting reality?

Headline statistics are often presented as if they tell the full story, but in London’s office market they blur structural differences. Brokers highlight overall vacancy near 10% to suggest tenant leverage, without clarifying that Grade A availability in core districts is below 1%. It’s a strange situation, and one that growth companies are left to navigate alone if they do not seek expert help.

BNP Paribas notes that Grade B space accounts for most of the available supply. Folding this into vacancy percentages creates the illusion of balance, while escalating prime rents prove demand is concentrated elsewhere.

Selective framing allows landlords to defend rising rents in Grade A offices while pointing to weakness in outdated buildings.

Key signs of selective presentation include:

- Vacancy rates that blend prime and secondary markets into one figure

- Net absorption totals reported as negative even as premium offices record gains

- Supply numbers inflated by obsolete buildings unlikely to meet energy standards

- Rent data reported by submarket without reference to building grade

This packaging of data creates a narrative of oversupply even as tenants face bidding wars for scarce viable space. For businesses, the challenge is recognising when numbers are being massaged into unreality.

Why clarity on office supply matters for growing businesses

The market reveals a dangerous illusion: London’s vacancy rates suggest abundance, but tenants are battling for a narrow slice of modern, ESG-ready buildings perfect for their next phase of growth. This distortion leaves scaling companies at risk of misjudging budgets, overpaying for underperforming space, or being trapped in leases that do not fit their growth.

At ADAPT, we cut through these averages and focus only on the spaces that matter for growth businesses – viable, scalable, flexible offices that attract talent, satisfy regulations, and protect long-term flexibility. And this includes incredible off-market and managed space. Because we are not brokers or landlords, but client-first problem solvers, our goal is alignment with your culture and growth stage, not filling vacant stock on behalf of buildings we own. This independence is our strength.

We source exclusive, flexible office space opportunities, negotiate terms that reflect true demand, and ensure every office feels like a home for your team. Whether it is a 10 person flex suite or a custom headquarters for 100+, we help businesses avoid getting trapped by misleading industry vacancy narratives.

Our track record proves that clarity creates confidence. Companies that partner with us do not just find the right building – they unlock modern spaces that adapt as they grow, without compromise.

So much of the London office space market story is built on daft averages and city-level generalisation. Our approach is always client-first and we always make sure scaling companies see past these industry averages and look only at the real market of actual availability in areas that work best for them.”

Chris Meredith, ADAPT CEO & Founder

What can you do to get ahead of the London office space availability illusion?

If you are expanding, adjusting headcount, or questioning if your current lease matches your future needs – now is the time to act. In a market where misleading averages create costly decisions, the right partner delivers clarity.

ADAPT does not just help you find space. We help you find the right space – flexible, credible, and fit for your growth. That is the ADAPT difference. You can start finding your perfect office workspace here.